As governments and businesses across the globe race to embrace digital transformation, one term continues to surface in legal and regulatory conversations: smart contracts.

Often hailed as a revolutionary innovation that will make legal processes faster, cheaper, and more secure, smart contracts – automated, self-executing agreements built on blockchain technology – are already making waves in finance, logistics, and digital commerce. But the legal sector, particularly in jurisdictions that emphasize regulatory control and due process like the GCC, is rightly asking: is this technology truly ready to become the new standard?

Let’s separate the hype from the real potential.

What Are Smart Contracts – Really?

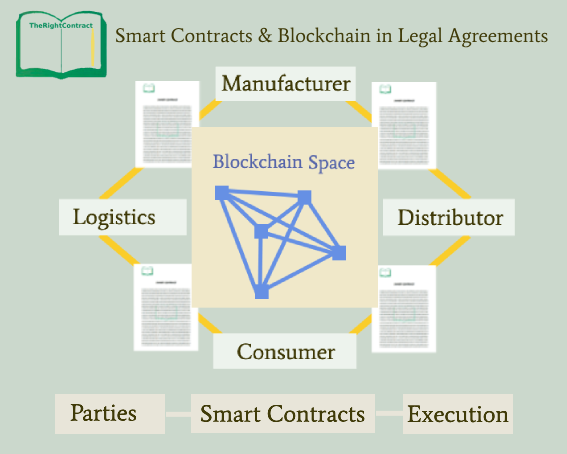

A smart contract is a piece of code that executes predefined rules when certain conditions are met. It sits on a blockchain network (usually Ethereum or a private enterprise chain) and performs tasks without needing intermediaries. Unlike traditional contracts, smart contracts are:

- Immutable: Once deployed, they can’t be changed.

- Transparent: Every transaction is visible and traceable.

- Autonomous: They execute themselves when conditions are met.

In essence, they are not “contracts” in the traditional legal sense – they are automated protocols that may or may not represent legally binding obligations depending on how they are drafted and where they are enforced.

Where Are Smart Contracts Being Used Today?

Smart contracts are no longer experimental – they’re increasingly being deployed in real-world scenarios:

- Supply Chain & Logistics: Companies use smart contracts to automate tracking and payment when goods arrive at checkpoints.

- Insurance: Claims are verified and payouts are issued automatically when conditions (e.g., flight delays) are met.

- Real Estate: Property transactions are being tokenized and managed through blockchain platforms.

- Government Pilots: The Dubai Blockchain Strategy aims to shift all government documents onto blockchain by 2030, and Saudi Arabia has explored blockchain for document verification.

Legal Reality Check: Are Smart Contracts Legally Enforceable?

This is where the line blurs. The enforceability of a smart contract depends on:

- Jurisdictional acceptance of electronic signatures and digital contracts.

- Legal recognition of blockchain records as evidence.

- Clarity in the underlying legal terms embedded in or linked to the code.

For example, the UAE’s Federal Law No. 46 of 2021 on Electronic Transactions and Trust Services provides a foundation for accepting digitally executed agreements – but not all smart contracts may meet these requirements without supplementary documentation.

Similarly, Saudi Arabia’s Electronic Transactions Law recognizes digital contracts, but there remains a need for human-readable clauses, especially in courts.

In short: smart contracts can be enforceable – but only if structured correctly and supported by proper legal frameworks.

Challenges That Must Be Addressed

Despite the promise, several critical issues remain:

- Lack of standardization: No universal framework yet exists for how smart contracts should be drafted.

- Code ≠ Law: Code can have bugs, and judges don’t interpret Solidity (the coding language for Ethereum).

- Cross-border complexity: Disputes involving smart contracts can quickly become jurisdictional nightmares.

- Human oversight is essential: Legal counsel must still ensure that rights, obligations, and remedies are properly accounted for.

How Platforms Like TheRightContract Could Adapt

At TheRightContract, our mission is to provide businesses and legal professionals with secure, efficient access to legal agreements – ready for the digital economy.

Smart contract integration is not just a technical upgrade; it’s a legal transformation.

We envision:

- Hybrid Contracts: Templates that contain both natural language terms and optional smart clauses (e.g., payment triggers, timestamps).

- Blockchain Timestamping: Adding blockchain-based proof of existence for uploaded contracts to establish authenticity.

- Legal Blockchain Certification: Offering contracts vetted for compatibility with smart execution platforms.

By incorporating blockchain as a layer of trust, rather than a replacement for legal judgment, we aim to future-proof our offerings while staying grounded in enforceable law.

Final Thoughts

Smart contracts hold undeniable potential. They are faster, cheaper, and tamper-resistant. But for the legal and public sectors – especially in jurisdictions that value rigorous legal compliance – the future lies not in fully replacing traditional contracts, but in smartly integrating automation into well-understood legal processes.

Rather than ask “Will smart contracts replace traditional contracts?” – perhaps the better question is: How can we make smart contracts legally sound, ethically managed, and practically useful?

TheRightContract is ready to lead that conversation.